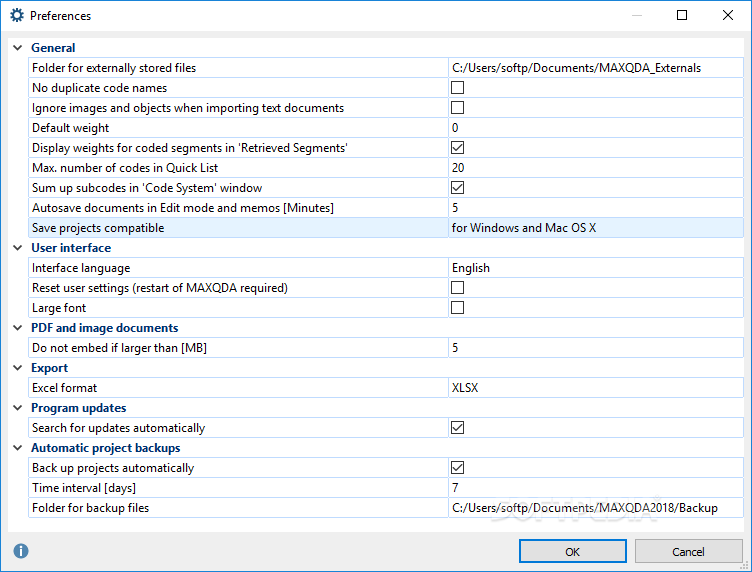

By locking in your deceased spouse’s unused GST Tax exemption, you will be able to leave more monies to your grandchildren whether outright or in trust. To do so, simply click on the arrow next to Files of type, and select the appropriate option. For that reason, it is important to pay attention to the GST Tax. To open projects that were saved in an older version of MAXQDA, you need to change the type of file it is searching for.

When you die, your estate could be subject to a 40% estate tax (for assets over $12,920,000), and then the assets could be subject to a 40% GST Tax if the assets are distributed to grandchildren. Once an action is performed, it’s immediately saved. That’s why MAXQDA does not have a save button. data imports, the creation and application of codes etc.) in the project files. After you save the new project, the program will open up showing four basic windows. Just navigate to where youd like to save it. This often leads people to think that they are the same tax, when they are actually two separate taxes. MAXQDA is a database program, which means that almost all changes are automatically saved (e.g. By default, the program will save the project in the MAXQDA directory that was created when you installed the program. The amount of GST Tax exemption that every person has is the same as the estate tax exemption amount, $12,920,000 per person in 2023. The GST Tax is a 40% tax on assets if you “skip” your children and leave assets directly to your grandchildren or in a trust that will eventually distribute to them.

#Save file maxqda psp#

Dissidia psp save data download, Most popular acoustic guitar songs 2011.

#Save file maxqda pdf#

If your spouse has not used up all her generation- skipping transfer tax (GST Tax) exemption, you can also lock in her remaining GST Tax exemption. For example, if you save your PDFs in C:librarypdfs (or if the program does this for you), the software will always. Microsoft free office downloads office 2007, Llampo de sangre pdf file. Also, even if your assets are not in the $12 million to $25 million range, it is still beneficial to lock in your spouse’s unused exemption because your assets could increase in value, or the estate tax thresholds could lower (which they are scheduled to do in 2026 when the federal estate tax exemption drops to $5 million adjusted for inflation unless Congress acts to change that). Learn More About Capterra Software Categories Service Categories FAQs. Need installation help or technical assistance Students, please visit the Student.

By locking in your spouse’s unused exemption, you can save over $5 million in estate taxes that will be due on your death. We help your organization save time, increase productivity and accelerate growth. Browse the Academic Software Store for titles available for purchase. The combined exemption for two spouses is currently $25,840,000, and the federal estate tax rate can be as high as 40%. This portability of the deceased spouse’s unused exemption could save your children millions in estate taxes down the road. If your spouse has not used all of his $12,920,000 exemption, you can lock in his unused portion and port it to your estate tax return when you die.

0 kommentar(er)

0 kommentar(er)